Maximum borrowing mortgage

Compare Quotes See What You Could Save. When all things are considered like your debt down payment and mortgage rate you might find you could borrow as much as 6 or 7 times your salary for a mortgage.

Fha Jumbo Loans In 2022

That largely depends on income and current monthly debt payments.

. Lender Mortgage Rates Have Been At Historic Lows. Buying a house is one of the largest investments many people are likely to make in their life. Get Offers From Top Lenders Now.

Without a big enough mortgage most hopeful home buyers are. Take Advantage And Lock In A Great Rate. Receive Your Rates Fees And Monthly Payments.

Theyll then calculate an exposure limit which takes into account how much credit exposure you already have. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Factors that contribute into the borrowing power calculation.

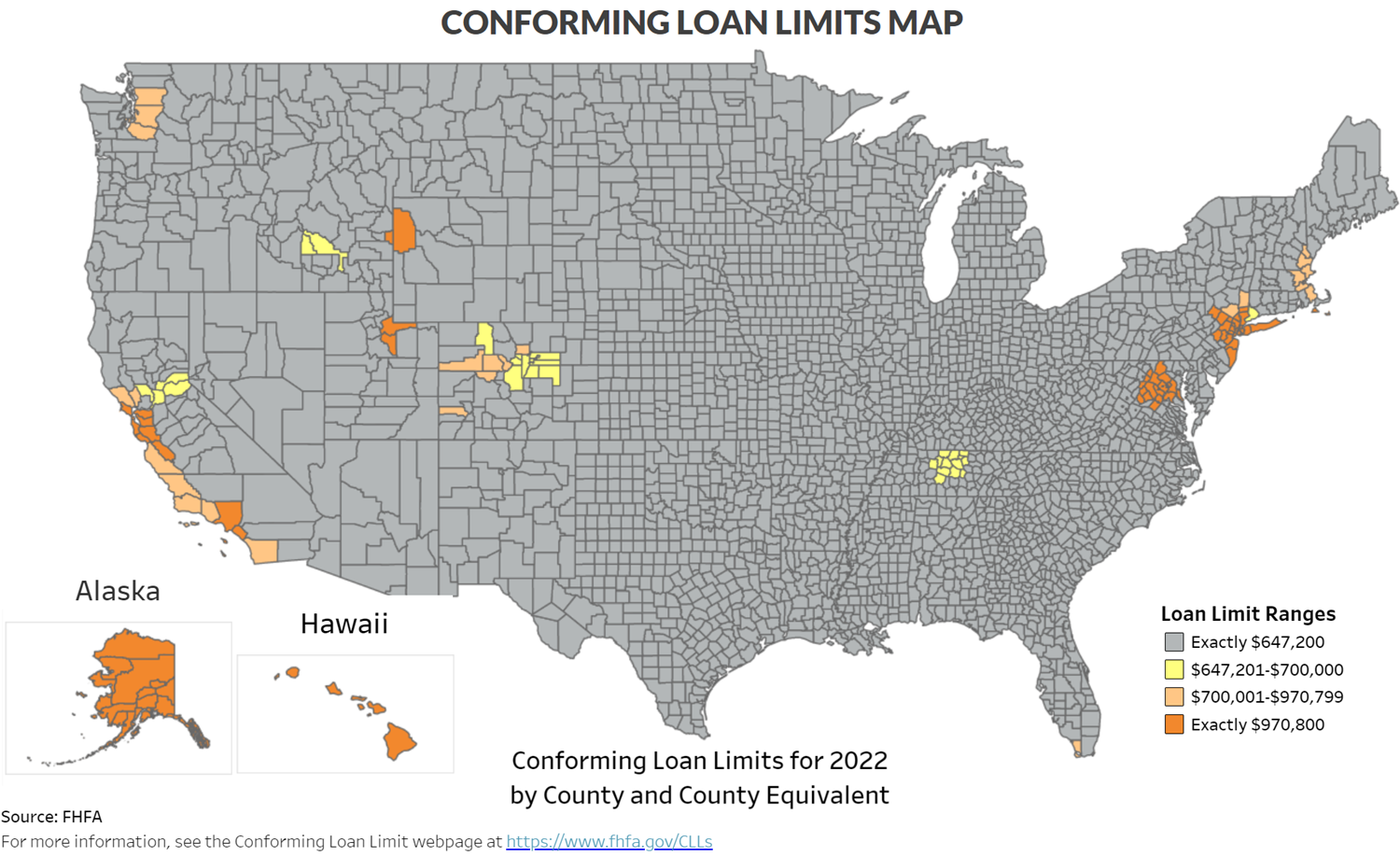

The Federal Housing Finance. Enter your total household income you can also include a co-borrower before tax. Ad FHA VA Conventional HARP And Jumbo Mortgages Available.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings - so the more youre committed to spend each month the less you. What is your maximum mortgage loan amount. Maximum Loan Amount.

For 2022 the Federal Housing Administration mortgage borrowing limit for an FHA loan is 970800 for a single-family home in Washington DC. Ad Find Mortgage Lenders Suitable for Your Budget. Select the links below for additional mortgage limits.

Adjust the termsometimes taking out a mortgage over a longer period can help you meet the affordability requirements on a deal and therefore boost your borrowing limits. FHAs nationwide forward mortgage limit floor and ceiling for a one-unit property in CY 2022 are 420680 and 970800 respectively. So if you approach a lender who has set an exposure limit of 1.

Browse Information at NerdWallet. Ad Learn More About Mortgage Preapproval. Maximum monthly payment is calculated by taking the.

Standard FHA limits for 2022 are listed below. Eligible Veterans service members and survivors with full entitlement no longer have limits on loans over. Describes the maximum amount that a borrower can borrow.

See Todays Rate Get The Best Rate In A 90 Day Period. If you have full entitlement you dont have a home loan limit. The maximum loan amount is based on a combination of different factors involving.

Some online mortgage calculators will give you a rough idea of how much you could borrow based on your income but its always best to shop around for a mortgage and. Try Our Maximum Mortgage Prime A Calculator This is your total principal interest taxes heat and 50 of your condo fee PITH. Ad Get an Affordable Mortgage Loan with Award-Winning Client Service.

FHA loans come with their own loan limits. Ad Get an Affordable Mortgage Loan with Award-Winning Client Service. But ultimately its down to the individual lender to decide.

As part of an. This maximum mortgage calculator collects these important. In most cases income from.

2020 2021 Conventional Conforming Loan Limits By County New Fhfa Gse Conforming Mortgage Limits

2021 Reverse Mortgage Limits Soar To 822 375

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Fha Loan What To Know Nerdwallet

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Guide To Reverse Mortgage Statements Heritage Reverse Mortgage

2022 Fha Loan Lending Limits

2022 Jumbo Loan Limits Ally

How Much Can I Borrow Home Loan Calculator

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

2022 Orange County Conforming Loan Limits Enjoy Oc

Determine A Max Home Loan Given A Monthly Payment Formula Youtube

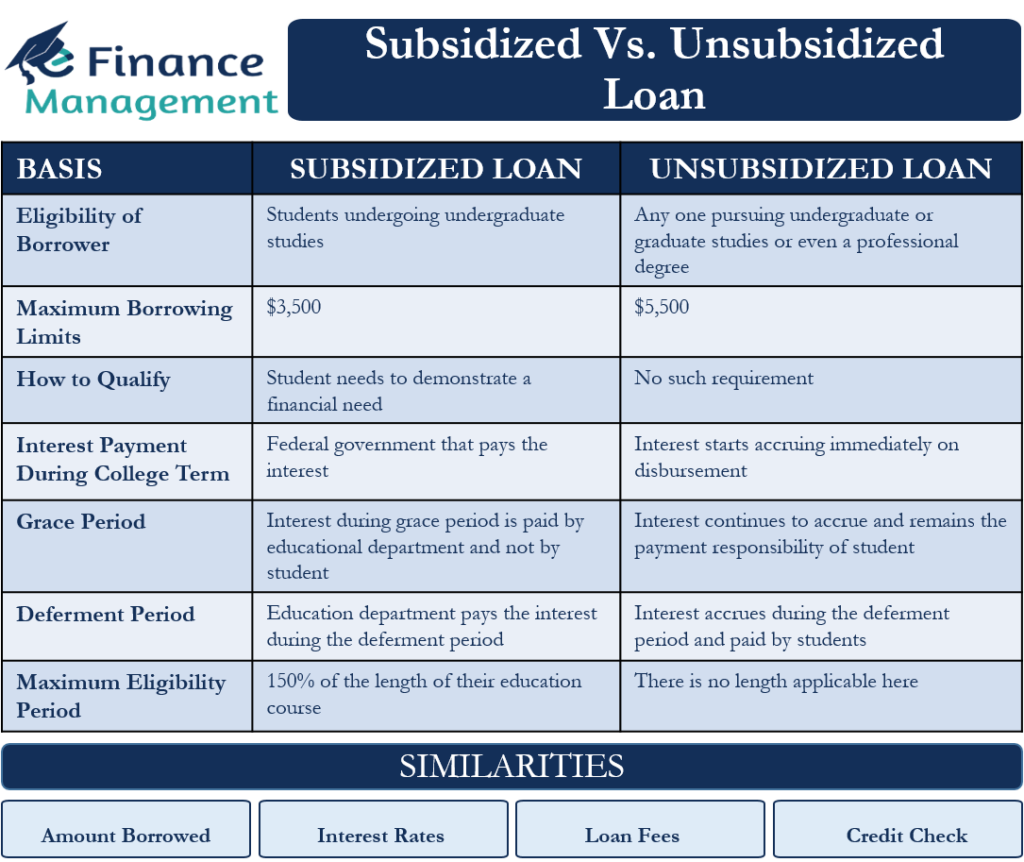

Student Loan Limits How Much Can You Borrow Penfed Credit Union

Subsidized Vs Unsubsidized Loan Differences And Similarities Efm

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

New 2022 Conventional Loan Limit Increase Gmfs Mortgage

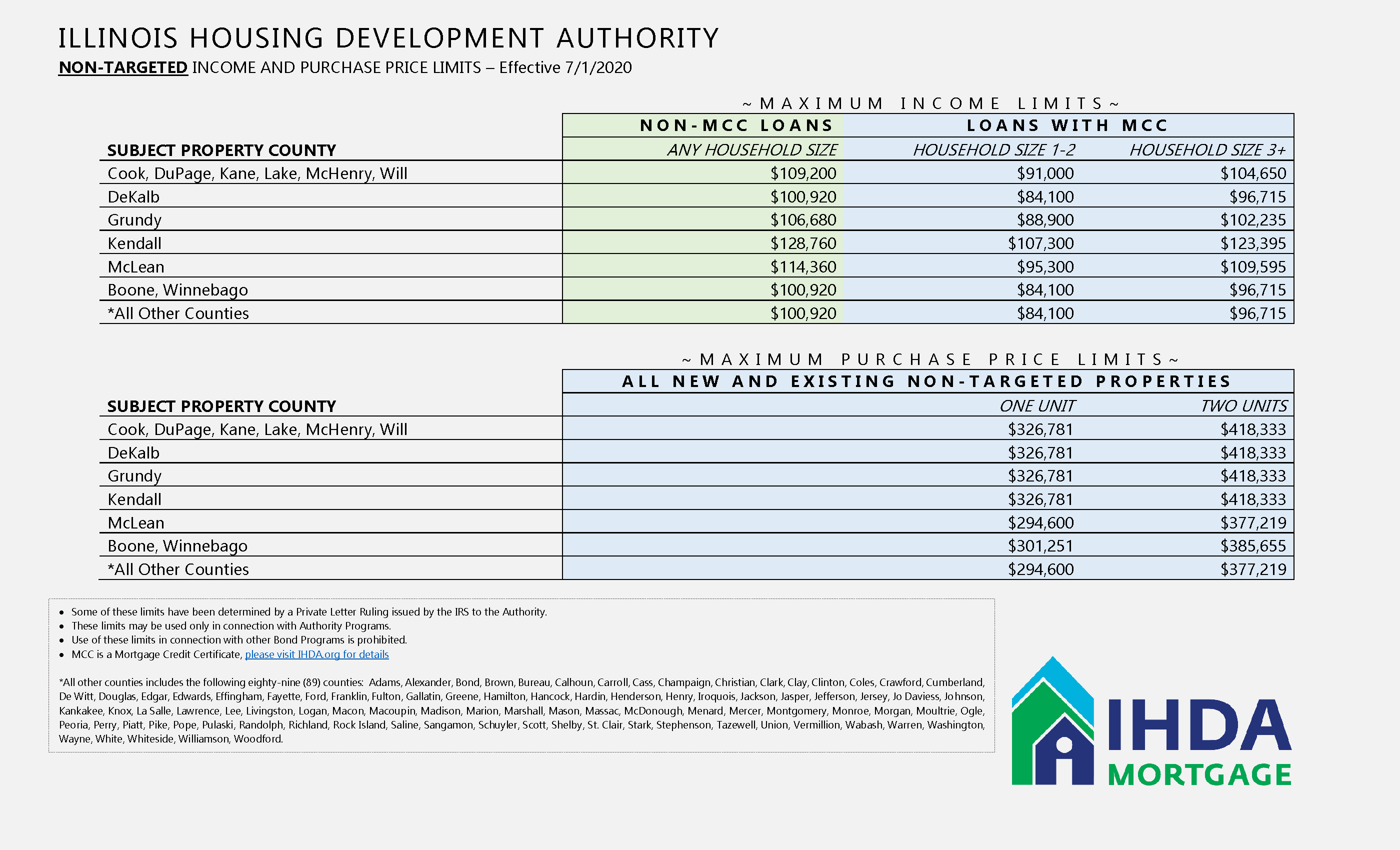

Income And Purchase Price Limits Ihda